This is page nine of a Health Savings Account Handbook guide. Start with page one to understand all of the ins and outs of Health Savings Accounts (HSAs).

Contents

Overview

Your Health Savings Account (HSA) is yours to manage, just like your other financial accounts such as retirement savings, investments, savings accounts, and credit cards.

Here’s how to handle it:

- Regularly Check Statements: Just like you would with a bank account, review your HSA statements every month. Make sure you recognize all the transactions. If something looks off or you don’t understand a charge, don’t hesitate to ask questions.

- Organize Your Records: Set up a filing system that works for you, making it simple to find what you need. Keep your receipts, statements, and any other records related to your HSA neat and orderly. This is crucial not only for when you need to get reimbursed or figure out your taxes but also to have proof of your claims if the IRS ever checks your tax return.

- Be Prepared for Inquiries: Sometimes questions or disagreements about bills and payments pop up well after a medical service was provided, even a year or two later. Organize your records so you can easily show how you’ve used your HSA funds, which can be invaluable in resolving these issues.

Treating your HSA with the same care as your other financial accounts will help you stay on top of your healthcare spending, maximize your tax benefits, and ensure you’re prepared for any questions or audits down the line.

Heads up – At harvest we’re building the tools to help every HSA/FSA holder maximize the value and keep the paperwork at bay

Handling paperwork

Keeping track of the money you spend, add, or make from your Health Savings Account (HSA) is kind of like when you figure out what you can subtract from your taxes because you spent money on certain things. But for your HSA, you’ll use different groups or types of spending and saving.

Submitting expenses

Submitting expenses to your HSA-eligible health plan

If your doctor or healthcare provider is part of your insurance network, they usually send your bill straight to your insurance company.

If they’re not in the network, you might have to send the bill to your insurance yourself.

This helps keep track of your deductible and the max amount you have to pay out of your pocket. Your insurance should give you a form to fill out for this, but often the bill you get from your doctor has all the info you need to file the claim.

Just make sure to keep copies of all your bills, so you have them if there’s ever a mix-up or disagreement.

Requesting withdrawals from the HSA

Some people who manage Health Savings Accounts (HSAs) give you a special debit card or a checkbook that lets you pay for medical stuff directly from your HSA.

If you want, you can also pay for these things with your own money, like from your bank account or credit card, and then ask your HSA to pay you back. Some HSA managers even let you move money online straight from your HSA to your personal account.

But remember, you can only get paid back for things you bought after your HSA was set up. You’ll find more info on this in the section about Health Savings Accounts.

Unlike with some other health plans or accounts, the company holding your HSA doesn’t check if what you’re asking to be paid back for counts as a medical expense.

That means you need to keep good records of everything, especially if you’re paying first with your own money and then asking for your HSA to pay you back.

Submitting expenses to another plan, like an FSA or HRA

If you used to have an FSA (Flexible Spending Account) and your job switches to a health plan that works with an HSA (Health Savings Account), and also includes an FSA or HRA (Health Reimbursement Arrangement) that meets HSA rules, turning in your bills will feel pretty familiar.

Just like with your old FSA or HRA, you’ll give your expenses to the people managing your account by showing them a detailed bill or the “explanation of benefits” form, which is a summary of your medical visit costs from your insurance.

Your new HSA-compatible FSA or HRA will handle these submissions in much the same way.

Reviewing insurance-related paperwork

Invoices and point-of-sale receipts

Starting January 1, 2020, you don’t need a doctor’s note to use your Health Savings Account (HSA) money for over-the-counter (OTC) meds.

That means you can buy stuff like pain relievers or allergy meds with your HSA, along with other things like diabetes supplies, canes, reading glasses, and bandages.

Make sure to keep detailed receipts for everything you buy with your HSA. These should include the date, what you bought, a description of it, and where you bought it from.

Explanation of benefits (EOB)

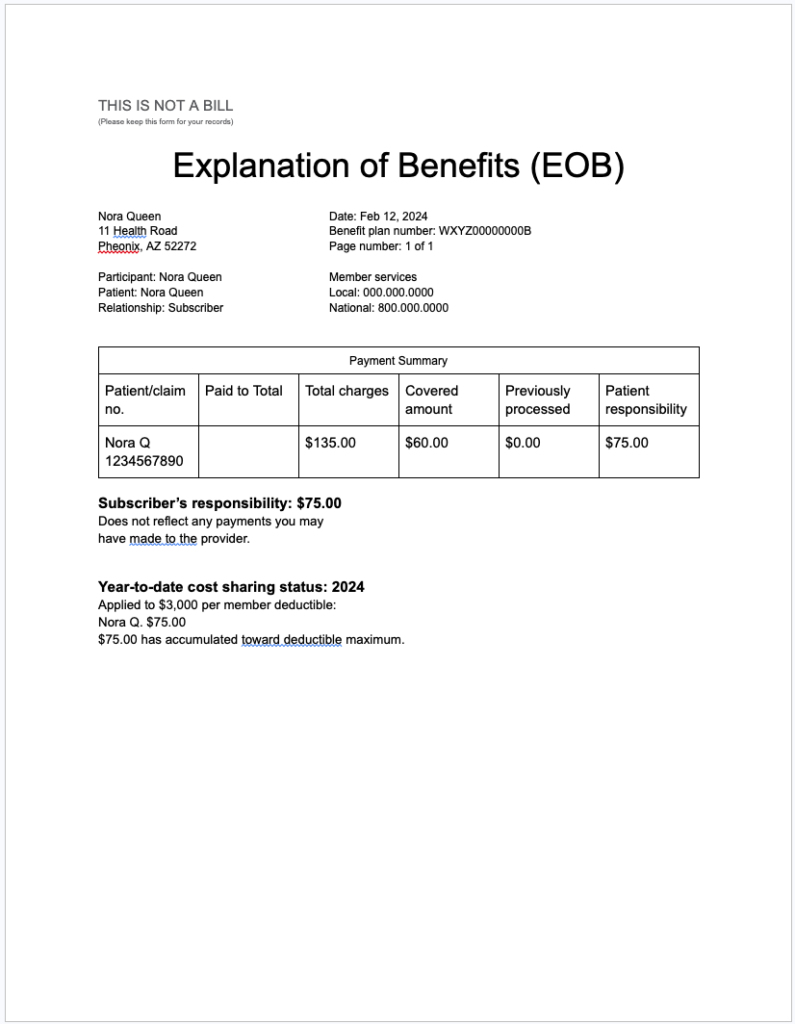

Your health insurance sends out an Explanation of Benefits (EOB) now and then, which is like a summary of your medical bills and payments.

It tells you the original amount the doctor or hospital charged, how much your insurance paid, and any discounts your healthcare providers agreed to with your insurance.

The EOB also breaks down how much money you need to pay, gives a recap of what services you got during your doctor’s visit, lets you know how close you are to meeting your deductible (the amount you need to pay before your insurance starts paying), and tells you how you can challenge anything in the EOB if you think there’s a mistake.

HSA statements

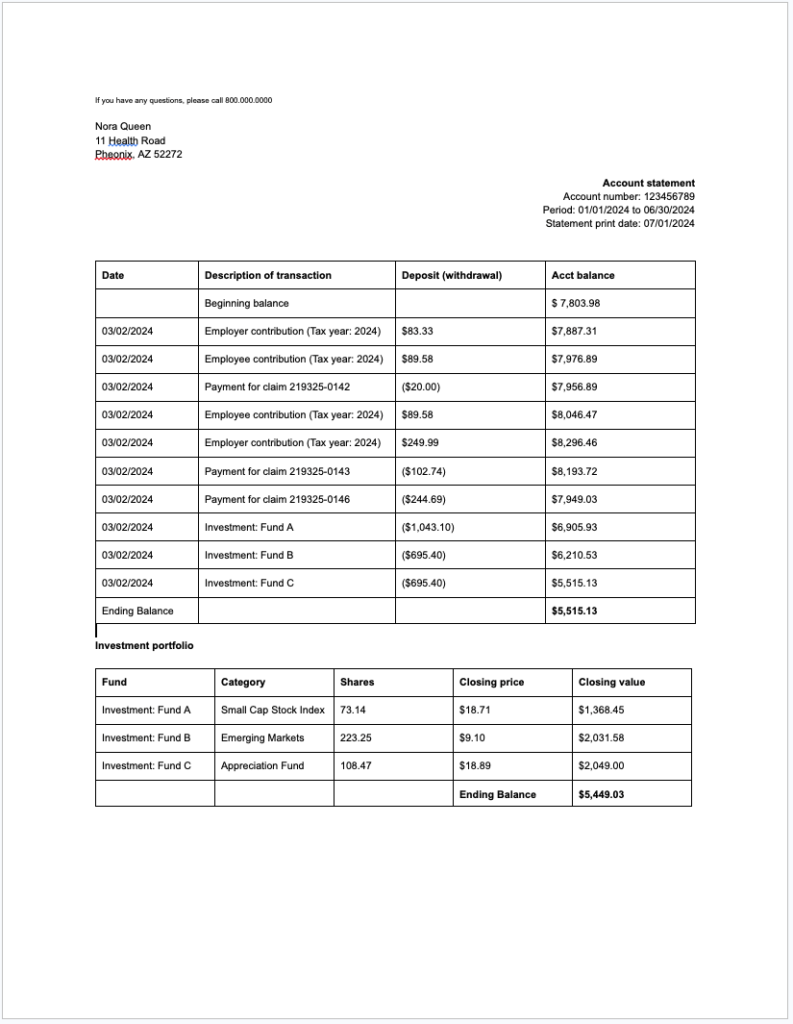

The person managing your Health Savings Account (HSA) will regularly send you a statement with important info about your account, such as:

- The money you’ve put into your HSA

- Any contributions made by your employer for you

- Payments your HSA has made for medical bills

- Money your account has made through investments or interest

- Any fees charged to your account

It’s a good idea to keep these statements organized and safe, just like you would with bank statements or other financial records. You might even want to keep them in the same place for easy tracking.

If you’re looking at your HSA as a way to save money over many years, you could end up using the funds for medical expenses way down the line.

Because of this, it’s smart to hang onto all your receipts and statements for at least three years after you’ve gotten money back from your HSA for any medical costs.

This is because if the tax folks decide to check your returns, they usually do it within three years, but sometimes it can take up to six years for them to get around to it.

Sample of explanation of benefits

Sample of periodic HSA statement

Tracking deductibles

The Explanation of Benefits (EOB) document from your health insurance helps you see how close you are to hitting your yearly plan limits, like your deductible and out-of-pocket max.

Understanding the deductible part of the EOB is key, and always use the latest EOB to make smart choices about your healthcare and how you’re going to pay for it.

If your Health Savings Account (HSA) manager doesn’t work closely with your insurance to track all your HSA payments for medical bills, you’ll need to put in extra effort to keep tabs on what you’ve paid.

Make it a habit to match up the info from your health plan’s paperwork with your HSA statements. If something doesn’t add up because of an issue with your health plan or HSA, you might need to get in touch with both the folks running your health plan and your HSA to sort out the mistake in both places.

In-network vs. out-of-network care

Most health insurance plans have different rules for the maximum amount you have to pay (out-of-pocket limits) and the amount you pay before your insurance starts paying (deductibles) depending on whether you go to doctors and hospitals in their network or outside of it.

Usually, this only really affects you if you have a year with really high medical costs or if you often go to doctors that aren’t in your plan’s network.

With a Health Savings Account (HSA) type of plan, the deductible might be higher than what you’re used to. So, it’s important to keep a close eye on how much you’re spending towards your deductibles and out-of-pocket limits for both in-network and out-of-network care.

This way, you can make better decisions about where to get your healthcare based on those costs.

Example: Choosing a network provider Ray has a self-only plan with a $1,700 out-of-pocket limit for in-network care and a $2,600 limit for out-of-network care. In-network care is covered at 100%, out-of-network care at 80%. His plan’s deductible is $1,700. Ray has spent $1,600 so far this year for in-network care and $250 for out-of-network care. He may have foot surgery that will cost $2,000. He can choose an in-network provider or one out of his network. If he chooses an in-network provider, he will pay $100, no matter what price the provider has negotiated with his plan. If he chooses an out-of-network provider, he will pay $400 ($2,000 x 20% non-network coinsurance).

Recordkeeping

Tracking how you use your HSA

In any health insurance plan, the plan will only pay for the services it says it covers. You usually find out what’s covered in the plan documents or a summary that your job or the insurance company gives you.

However, when you have a Health Savings Account (HSA), you get to use that money for a lot of different health-related costs, but only the ones allowed by the HSA rules and the IRS’s list of qualified medical expenses.

It’s really important to know which expenses are allowed and to keep all the receipts and documents that prove you spent your HSA money on these allowed expenses.

If you don’t have this proof and you use HSA money for something not allowed, you could get hit with a 20% fine plus taxes on the money you spent wrongly.

Keeping accurate records

You can use any financial software or a simple spreadsheet to help you keep an eye on your medical spending. But, if you ever need to prove a medical expense or challenge a bill, you’ll need the original documents, either on paper or as digital files.

Some companies that manage Health Savings Accounts (HSAs) have apps that let you easily snap pictures and save these documents right from your phone.

Make sure to keep your HSA paperwork for as long as your account is open, even if you switch to a different HSA provider or can’t put money into your HSA anymore.

Your HSA can also cover costs that your health insurance doesn’t, like chiropractic care, for example. So, it’s good to know what your HSA can pay for, even beyond what your health insurance covers.

Organizing HSA and health plan records

When it comes to keeping track of your healthcare paperwork, you’ve got a couple of choices. You can go old-school and keep physical copies of all your documents.

A simple folder with multiple pockets or a binder with dividers works great for this. Just remember, if the IRS ever wants to check your stuff, you’ll need to have the original documents or clear copies of them.

Or, you might prefer to keep everything digital. You can scan your documents and save them on your computer or in the cloud. Using financial software or apps from your HSA provider can help you keep tabs on what you’re spending.

Whichever way you choose, here’s a way to set up your system:

- In-Network Bills and Payments: Keep all the bills and payment proofs from doctors in your plan’s network. Include copies of checks or credit card receipts if you didn’t pay directly from your HSA.

- Out-of-Network Bills and Payments: Do the same for bills from doctors outside your network.

- Explanation of Benefits (EOBs) from In-Network: Keep these in order from newest to oldest so you can easily see how much of your plan’s limits you’ve used up.

- EOBs from Out-of-Network: Same deal, but for out-of-network stuff.

- Expenses Not Covered by Your Plan: Keep all the receipts and detailed bills for stuff your insurance doesn’t cover. These are important because you can use your HSA for these expenses.

- HSA Statements: Keeping these in order from newest to oldest helps you quickly see the most recent info.

Make sure your system lets you see which expenses have been submitted, paid, or are still waiting to be paid.

Label everything with the year and start a new file each year to keep things easy to manage as time goes on.

Storing records electronically

If you decide to keep your records digital, it’s smart to back them up both at your place and somewhere else. (Harvest can help with this)

This way, if something bad happens, like a flood or fire, you won’t lose everything because your computer and backup at home could get ruined. When picking a cloud service for your backup, be picky because some don’t protect your data well, which could let hackers or others see your info.

Also, some companies that manage Health Savings Accounts (HSAs) let you access your claims and account activity for a long time, which can be super helpful for keeping track of expenses and getting reimbursed later on.

Disputing charges

If you get a medical bill that seems wrong or confusing, don’t hesitate to get in touch with your healthcare provider’s office or the customer support for your health insurance plan—or maybe even both. If there’s a mistake on your bill, try to sort it out quickly.

Mistakes happen, especially in busy medical offices that have to deal with lots of different health insurance plans, which can change their rules often.

Plus, patients’ insurance plans can change too. It’s up to you to stay on top of things and follow up to make sure everything is correct with your bills and payments.

Expressing disagreement with your health plan

Every now and then, health insurance plans might mess up when handling claims. They could mix up and treat a bill from a doctor within their network as if it came from outside their network, or they might get someone’s birthday wrong, leading to a denied claim.

Mistakes like these can mess with how close you are to having your insurance start paying for things, or how much you’ve paid towards your deductible for the year.

So, if you spot an error, it’s important to deal with it right away.

When you disagree with your HSA statement

Just like sometimes you might find a charge on your credit card that you didn’t make—maybe because someone stole your info or just a mix-up—if you have a debit or credit card for your Health Savings Account (HSA), you should check the charges on it the same way you do with your credit card bills.

It’s important to know what you can do if you don’t agree with a charge on your HSA card, like how to get the charge checked out or taken off your account.

If your HSA comes with a checkbook, you should also know how to stop a check from being cashed and what steps to take if you ever lose your checkbook.

The rules for checkbooks and debit cards are different, so the way you can challenge a charge might change based on how you used your account.

Meeting IRS requirements

Since your Health Savings Account (HSA) gets special tax breaks, the IRS sets rules on how you can use the money in it.

You can take your time submitting claims for qualified medical expenses to your HSA, even long after you’ve had those expenses.

But, no matter when you decide to submit an expense, you need to have all the right documents ready to show the IRS in the year you claim the expense or take the money out, if they ask for it.

Meeting HSA-qualified health plan deadlines

If your job switches from one HSA-qualified health plan to another, or if they stop offering an HSA-qualified plan altogether, make sure that the right health plan covers the medical costs you’ve already racked up.

You might have to work out how your HSA fits with the new health plan. If your employer changes to a different kind of plan or if something changes with your spouse’s insurance that makes you not able to put money into an HSA anymore, you have to stop your contributions starting the first day of the month after your HSA-qualified coverage ends.

For instance, if your HSA-qualified coverage stops on June 15, you can’t put money into your HSA starting from July 1. But, you can still use the money that’s already in your HSA for medical costs that qualify.

Saving receipts and statements

You need to keep proof that you used your Health Savings Account (HSA) money for eligible health-related costs.

The company managing your HSA, your health insurance, and your employer will help with some reports about your account, but they won’t keep track of whether your spending was on qualified expenses.

This is where Harvest comes in. All of our record keeping tools are free to use.

The IRS usually has three years after the due date of your tax return (including any extensions you got) to check your taxes. So, if you filed your 2022 taxes by the extended deadline of August 15, 2023, the IRS could audit you up until August 15, 2026.

However, if you report less income than you actually made by more than 25%, the IRS might look into your taxes up to six years later. And if there’s suspicion of fraud, there’s no time limit on when they can audit.

It’s wise to keep records of your HSA spending for as long as you could be audited, and even for as long as you have the account.

Even if your HSA gives you a special debit or credit card, or a checkbook for medical expenses, you might still need to ask for money back from your HSA later—for example, if you forgot to use it at the time, or didn’t have enough in it to cover a bill.

If you don’t keep your receipts organized, you might miss chances to use your HSA and end up spending your own money after taxes for medical costs.

Some people choose to do this on purpose to let their HSA balance grow, planning to get reimbursed tax-free later using their saved receipts.

Make sure to get all the necessary paperwork in case your health plan changes and you can’t get to the health plan’s online info anymore.

Example: Delaying reimbursement (What Harvest recommends) Larry has had an HSA-qualified health plan for years and built the balance in his HSA up to more than $150,000. Larry plans to retire soon, but will wait to take Social Security until after 70 to maximize his monthly benefit. Larry diligently pays any out-of pocket expenses with after-tax funds (on his credit card) and saves the documentation, keeping a running total qualified expenses (Harvest can help you manage this). Just before Larry retires at age 69, he requests a distribution of $75,000 (which equals his take-home pay) to reimburse expenses he previously paid with after-tax dollars. This distribution will fully fund his first year of retirement, allowing him to postpone his Social Security benefits until they reach their maximum benefit level.

Paying taxes

Deductions

Your employer will list any contributions they make to your Health Savings Account (HSA) on your W-2 form, which is the form you get that shows your income from your job.

The organization that holds your HSA (called a trustee or custodian) will tell both you and the IRS about the money you took out of your HSA using a form called 1099-SA, and they’ll report the money put into your HSA on another form called 5498-SA.

Whether it’s your employer, you, or someone else who puts money into the HSA (like if your HSA isn’t part of a job benefit), those contributions can usually be deducted from your federal income taxes, and that’s also true for most state taxes.

Tax benefits from contributions made by others

Even though someone other than you or your employer (like a family member) can put money into your Health Savings Account (HSA), they can’t lower their taxes with that contribution.

But you, as the account owner who got the contribution, can deduct that amount from your total income when you do your taxes.

Example: Making contributions to an adult child’s HSA Mel and Mary’s 24-year-old son Charles attends college—too old to qualify as a tax dependent, but young enough to retain coverage by his parents’ HSA-qualified health plan. Mel helps Charles open his own HSA and makes a $1,000 contribution to it. Mel and Mary cannot deduct the $1,000 on their own tax return, but Carlos will not include it in his gross income.

Deductions for an employee or individual purchaser

To figure out how much you can deduct from your taxes for contributions to a Health Savings Account (HSA) or similar plan, you’d break down the total deductible amount by the number of months you were eligible.

This way, you calculate the deductible amount for each month.

When you’re doing your taxes, you can list this contribution as an “above-the-line” deduction. This means you subtract it from your total income before you figure out your adjusted gross income (AGI).

If you’re part of a cafeteria plan at work, where you pick and choose from a set of benefits, your contributions are made with pre-tax dollars. This will be shown on your W-2 form that you get from your employer, which helps lower your taxable income.

Example: Making an HSA contribution an above-the-line deduction Hugo, a single taxpayer, makes $36,000 a year and contributes $1,000 to his HSA. On his tax return, he can only deduct medical expenses that exceed 7.5% of his adjusted gross income if he itemizes his deductions on Schedule A. Hugo has not had any medical expenses for the year. He can, however, take an above-the-line deduction by subtracting the $1,000 HSA contribution when calculating his adjusted gross income through completion of IRS Form 8889.

Double-dipping (DON’T Do it!)

You can’t use an HSA contribution as a write-off for medical expenses when you’re listing out deductions one by one (itemizing).

Also, you can’t ask for money back for the same medical bill from two different health plans.

But, if you’re allowed to have an HSA, you can deduct money put into it on your taxes (except for the part that was already taken out of your paycheck before taxes) even if someone else actually puts the money in for you.

Contributions

Employer-provided coverage

When your employer puts money into your Health Savings Account (HSA), the IRS sees it as part of your health benefits from work.

This means the amount your employer contributes isn’t included in the income you have to pay tax on, as long as you’re allowed to have an HSA.

These employer contributions don’t get hit with regular income tax deductions from your paycheck, or with taxes for Social Security and Medicare (which is what FICA is), federal unemployment taxes (FUTA), or taxes for railroad workers’ retirement.

However, in some places, state taxes might still apply to what your employer contributes to your HSA.

Self-employed individuals and owners of S corporations

If you’re self-employed or a shareholder-employee owning more than 2% of an S corporation, you’re not seen as an employee in the traditional sense, so you can’t get employer contributions to a Health Savings Account (HSA).

But, you can still put your own money into an HSA and then deduct that amount from your taxes right off the top of your income, which is called an “above-the-line” deduction.

For partners in a partnership, any contributions to an HSA are considered part of their share of the business income, which they report on a special tax form (Schedule K-1 from Form 1065).

They can include these HSA contributions in their earnings from the business and then deduct them when they’re figuring out their total income for taxes, just like any HSA owner can.

For shareholders in an S corporation who own more than 2%, any money the business puts into their HSA is treated as part of their pay for the work they do.

They need to add this to their business income but can then deduct the HSA contribution from their total income when doing their taxes.

General tax forms

Wage and tax statement (W-2)

Employers need to fill out a W-2 Form for each employee they’ve paid during the tax year. When you do your taxes, you have to include this W-2 with your tax forms for federal, state, and local taxes.

Any money your employer puts into your Health Savings Account (HSA), including the money that comes out of your pay before taxes through a cafeteria plan, gets reported in Box 12 of your W-2, and they use the code “W” to mark it, as the tax form instructions say.

US individual income tax return (Form 1040)

If you put more money into your Health Savings Account (HSA) than the allowed maximum ($3,650 for individuals or $7,300 for families in 2022), the extra amount adds to your adjusted gross income (AGI).

As the HSA owner, you need to report this extra contribution and figure out the penalty tax using Form 5329.

Make sure to list any HSA contributions you made with after-tax dollars on Form 1040 to help calculate your AGI. Also, if you take money out of your HSA for things that aren’t qualified medical expenses, you need to report these distributions on Form 8889.

Forms related to medical expenses and Health Savings Accounts (HSAs)

The amounts you see on Forms 5498-SA (which reports contributions to your HSA) and 1099-SA (which reports distributions from your HSA) need to match up with the numbers you put on your Form 1040, the main tax return form.

This ensures consistency in your tax reporting and helps avoid issues with the IRS.

Contributions to Medical Savings Accounts (Form 5498-SA)

The organization holding your Health Savings Account (HSA) will tell both you and the IRS how much was contributed to your HSA during the year, using Form 5498-SA.

This form isn’t just for HSAs; it’s also used for reporting contributions to other types of medical savings accounts, like Archer Medical Savings Accounts (Archer MSAs) and Medicare Advantage MSAs (MA MSAs).

Distributions from Medical Savings Accounts (Form 1099-SA)

The entity managing your Health Savings Account (HSA) will inform both you and the IRS about any money you’ve taken out of your HSA over the year using Form 1099-SA.

This is why it’s important to keep detailed records, so you can show that the withdrawals you made were for allowable medical expenses.

Form 1099-SA is also used for other types of medical savings accounts like Archer MSAs and Medicare Advantage MSAs (MA MSAs), not just HSAs.

HSAs (Form 8889)

If you or your spouse (if you’re filing taxes together) had any activity in your Health Savings Account (HSA) during the year, like putting money in or taking it out, you need to file Form 8889 along with your tax return (Form 1040 or 1040NR).

You have to do this even if the only money going into your HSA was from your employer or your spouse’s employer.

If you were involved with more than one HSA during the year—either because you have multiple HSAs or you’re a beneficiary of someone else’s HSA in addition to having your own—you need to fill out a separate Form 8889 for each HSA. Mark each of these forms as “statement” at the top and follow the instructions to fill them out.

Then, fill out one main Form 8889 where you add up everything from your individual statement forms.

Attach all these statement forms to your tax return, behind the main Form 8889.

If both you and your spouse have HSAs and you’re filing together, you’ll each need to complete your own Form 8889 because there isn’t a combined form for spouses.

Taxable contributions and distributions (Form 5329)

Form 5329 is used to figure out if you’ve put in too much money into your Health Savings Account (HSA) or taken out more than allowed by IRS rules.

If something big happened in your life, like getting divorced, and it changed your insurance coverage, this form can help you see if that’s going to cost you extra in taxes.

If you end up having income from your HSA that you need to pay taxes on, like from putting in too much money or taking out money for non-medical reasons, you’ll face penalties—6% for putting in too much money and 20% for spending money on non-qualified expenses in 2022.

If your math on Form 5329 shows you owe these taxes or penalties, you have to include this form when you file your taxes.

Summary

There are various ways to handle healthcare costs:

- In-Network Provider Claims: When you see a doctor or get healthcare services in your plan’s network, the provider usually sends the bill directly to your insurance company.

- Filing Claims Yourself: If needed, you can submit your healthcare bills to your insurance company on your own.

- Using Your HSA: You can pay for healthcare directly using a debit card linked to your Health Savings Account (HSA), or you can pay out-of-pocket and then ask your HSA to pay you back.

- Using Your FSA or HRA: If you have a Flexible Spending Account (FSA) or a Health Reimbursement Arrangement (HRA) that’s compatible with your HSA, you might choose to use these for reimbursements first, especially if they have a “use-it-or-lose-it” policy, which can make saving in your HSA even more tax-efficient.

- Keeping Organized Records: Maintain a good system for keeping track of bills, receipts, EOB documents, and HSA statements. You can keep physical copies or digital ones, but make sure to have secure backups.

- Understanding HSA Benefits: Your HSA can cover a broader array of expenses than your regular health plan might, so stay updated on what’s eligible to get the most out of it.

- Tracking Deductibles: Use your records to keep tabs on how much you’ve spent towards your deductible. This can help you plan larger non-emergency healthcare expenses more strategically.

- Avoiding Billing Surprises: Good record-keeping means you’re less likely to be caught off-guard by bills that arrive late, helping you manage your finances better.